In today’s world, where finances and investments are part of our lives, it is crucial to understand the occurrences of fraud and know about the individuals involved. One such person making news is Edward Constantinescu. The case of Edward emerges as a point of discussion for investors, legal experts, and regulatory authorities. This revolves around accusations involving a $114 million securities fraud plot.

In this blog, we intend to make an overview of the intriguing case of Edward Constantinescu who alleged a $114 million securities fraud scheme. Moreover, we will look into how it affects the integrity of the market and investor confidence. We will cover the multiple dimensions of this intricate affair to understand it in a better way.

Our objective with this overview is to share important information and recommendations that can protect investor interests and uphold the integrity of the financial markets.

Understanding Securities Fraud

At the heart of Edward Constantinescu’s story lies the concept of securities fraud, a term that might sound complex but boils down to cheating in the stock market. Imagine playing a game where some players secretly know the outcome and use that knowledge to win money from others. This is somewhat analogous to what Constantinescu and his associates are accused of doing, albeit on a much larger and more sophisticated scale.

Constantinescu ‘s example lies in the concept of securities fraud, a term that might sound complex but in reality, is cheating in the stock market. In a simpler way: Imagine you are playing a game where some players secretly know the outcome and use that knowledge to win money from others.

This is somewhat analogous to what Constantinescu and his associates are accused of conducting on a much larger and more sophisticated scale. Rather than just a game among friends, it involves lots of money—like, a whole lot, to the tune of $114 million. They supposedly knew certain information that others didn’t, used this to their advantage, and made a lot of money while other people, who didn’t have this information, ended up losing money. It’s like cheating in a game but with serious real-world consequences for lots of people.

The Art of Deception

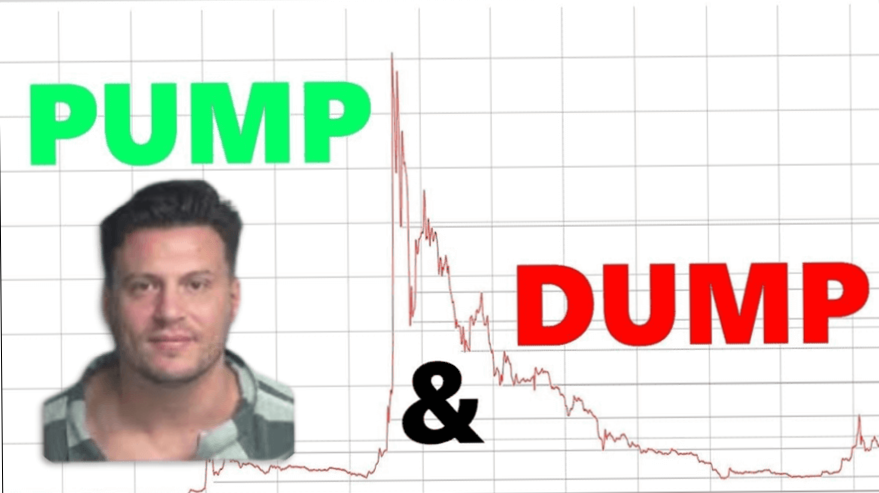

The scheme Edward and his team are accused of involves a tactic called “pump and dump.” Here’s how it works:

First Step: The Pump

Imagine you’re at a market, and someone starts spreading the news that a certain fruit is going to be super rare and valuable soon. Because of this news, everyone starts buying that fruit, thinking they can sell it for a lot more later.

This is similar to what Edward and his team supposedly did. They used the internet to tell everyone great things about certain stocks. These stories weren’t all true, but they got people excited. As more people heard these stories and believed them, they started buying the stocks, hoping to make a quick profit. This demand made the stock prices shoot up high, just like the fruit everyone thought would become rare.

Second Step: The Dump

Now, back to our market example, imagine that the person who spread the news about the fruit has a lot of it and sells it all when the price is at its highest. Suddenly, there’s plenty of fruit, and it’s not rare at all. The price plummets.

In the stock market, after the prices of the stocks were pumped up and reached a peak, Edward and his team then sold all their shares at this high price. They made a lot of money because they sold when the price was up. But when they stopped spreading the news and everyone realized the stocks weren’t as good as they thought, the prices fell sharply. The people who bought the stocks late, thinking they would go up even more, ended up losing a lot of money because now the stocks were worth much less than what they paid.

This “pump and dump” tactic is like spreading the news to make everyone rush to buy something, only to sell what you have at the highest price and then watch as everyone else finds out the truth and loses money. It’s a sneaky way to make money by tricking people, and it’s not fair to those who end up losing out.

The Characters: Investors and the Market

This story is not just about Edward Constantinescu; it involves everyone who participates in the stock market. From seasoned traders to mom-and-pop investors saving for retirement, the ramifications of such schemes ripple across the entire financial ecosystem.

It highlights the vulnerability of trust and the cascading effects of deceit in a system built on confidence.

The Role of Social Media

A compelling aspect of this modern-day saga is the use of social media as a tool for market manipulation. Platforms that connect us, share our life milestones, and spread news can also be wielded to manipulate perception and, by extension, stock prices. This dimension of the story underscores the double-edged sword of technology in our interconnected world.

One really interesting part of this story is how social media was used to mess with the stock market. Social media sites are places where we all connect, share important moments from our lives, and find out what’s happening in the world. But this story shows that these same sites can be used in tricky ways to change what people think about certain stocks.

Think of social media like a big, public square where everyone comes to chat and share news. Now, imagine if someone started spreading news in this square that a certain shop was selling the best, most valuable items ever. Even if it’s not true, people might start rushing to buy from that shop, thinking they’re getting something special.

Social Media’s Role in Market Manipulation

This is kind of what happened with the stock market. Some people used social media to spread fake information that certain stocks seem good. Because so many people saw these stories and believed them, they started buying those stocks, making the prices go up.

But here’s the catch: just like a rumor in the public square can make everyone rush to a shop. A rumor on social media can make people rush to buy stocks. And when the truth comes out—that the stocks aren’t as great as the rumors said—they lose value, and people lose money.

This shows us the powerful role technology and social media play in our world today. They can help us stay connected and informed, but they can also be used in ways that aren’t so good, affecting things like the stock market and people’s money. It’s like a two-sided coin: technology brings us together and helps us share information, but it can also be used to mislead and manipulate.

The Moral: Due Diligence and Skepticism

For readers, the unfolding case of Edward Constantinescu serves as a potent reminder of the importance of due diligence. In a world awash with information, the ability to sift through noise, question the source, and critically assess investment opportunities is more crucial than ever. It encourages investors to build a foundation of skepticism, not cynicism, towards what they read and hear, especially when it concerns their hard-earned money.

The Bigger Picture

As the legal proceedings against Constantinescu and his co-defendants advance. The case transcends the individuals involved, touching on broader themes of market integrity, regulatory oversight, and the eternal battle between greed and ethics.

It’s a reminder that in the stock market, as in life, shortcuts to wealth can have profound consequences, not just for the schemers but for the entire community.

In essence, the Edward Constantinescu case is not just a cautionary example of securities fraud; it’s a complex matter about the interplay of technology, trust, and the timeless allure of quick riches in the stock market. This situation clearly demonstrates the old saying that if something appears too perfect to be real, it likely isn’t.

Recommendations for Investors

Investing in the stock market can be rewarding, but it requires careful consideration and informed decision-making. Investors must conduct thorough research before committing their money, understanding the companies they’re investing in and their growth potential. Being skeptical of investment advice, diversifying one’s portfolio, and aligning investments with personal risk tolerance are key strategies for minimizing risk. Additionally, maintaining a calm and rational approach, utilizing stop-loss orders, staying informed about market developments, and seeking professional advice when needed can all contribute to a safer and more successful investing experience. By following these recommendations, investors can navigate the stock market with greater confidence and security, working towards their long-term financial goals while mitigating potential risks.

FAQs: Understanding the Edward Constantinescu Securities Fraud Case

Understanding Securities Fraud

What is securities fraud?

Securities fraud involves deceptive practices in the stock market, like spreading false information to manipulate stock prices for profit.

Edward Constantinescu’s Involvement

Who is Edward Constantinescu?

Edward Constantinescu is an individual implicated in a $114 million securities fraud scheme, accused of manipulating stock prices for personal gain.

The Alleged Fraud Scheme

How did the alleged fraud work?

The alleged scheme, known as “pump and dump,” involved promoting stocks with false or misleading information to inflate their prices (the pump), then selling off those overvalued stocks at a profit (the dump), leading to losses for other investors when the truth was revealed and stock prices plummeted.

Role of Social Media

What role did social media play in this case?

Social media was reportedly used as a tool to spread the overly positive, often false information about certain stocks, influencing investor perception and stock prices.

Implications for the Stock Market

What are the implications of this case for the stock market?

This case highlights the vulnerabilities of the stock market to manipulation, underscoring the importance of market integrity and the need for investor diligence.

Investor Protection

How can investors protect themselves from such schemes?

Investors can protect themselves by conducting thorough research, being skeptical of information that seems too good to be true, and considering the source of investment tips, especially those found on social media.

Legal Proceedings

What is the current status of the legal proceedings?

As of the last update, Edward Constantinescu and his associates have pleaded not guilty and are contesting the charges in court. The outcome will depend on the legal process and the evidence presented.

Significance of the Case

Why is this case significant?

This case serves as a cautionary tale about the potential for fraud in the digital age and the critical role of regulatory oversight and investor education in maintaining a fair and transparent market.